Samsung Biologics, one of the world’s largest contract development and manufacturing organizations (CDMOs), has released its earnings report for the third quarter of 2022. The report noted that Samsung Biologics’ cumulative revenue for the fiscal year has exceeded KRW 2 trillion (approximately $1.51 billion). Q3 saw the launch of the CDMO’s expanded end-to-end mRNA vaccine production suite, which contributed to its reported consolidated revenue of KRW 873 billion, operating profit of KRW 324.7 billion, and net profit of KRW 129.2 billion.

“This past quarter saw strong performance and growth due to a consistent momentum in signing new contracts, helping us meet client demand for integrated offerings and deliver long-term value,” said John Rim, president and CEO of Samsung Biologics. “Not only have we delivered on our commitments by commencing [good manufacturing practice] operations of Plant 4 within just 23 months from the start of its construction, but we have also developed and launched our next-generation biotechnologies — S-DUAL and DEVELOPICK — which will help streamline and accelerate the antibody development process to save time and cost for our clients.”

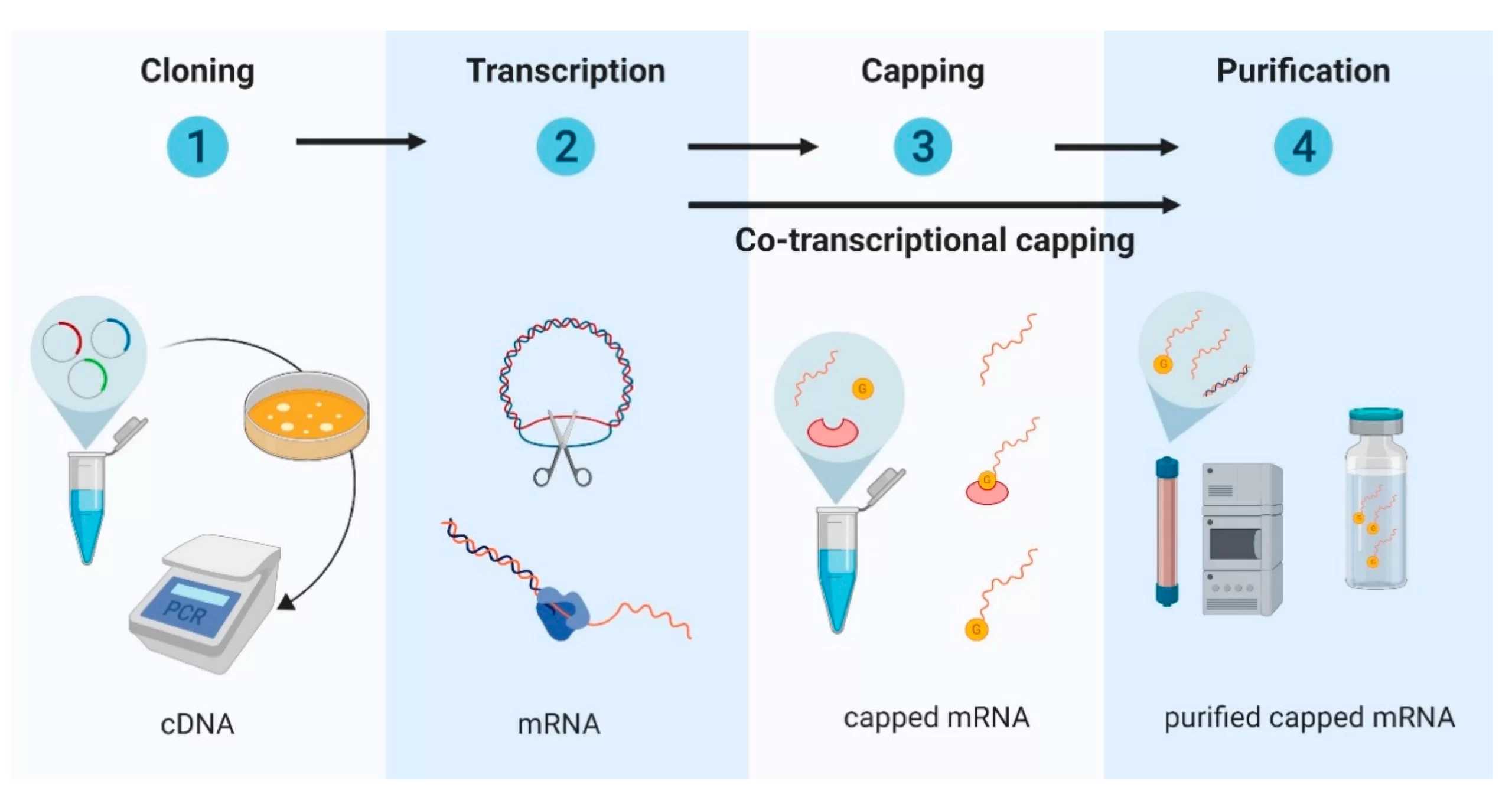

The CDMO’s expanded mRNA vaccine production capabilities are a recent addition to these integrated offerings, and it completed its first commercial-scale production run in August.

Building on End-to-End mRNA Vaccine Production

Samsung Biologics had experience in mRNA vaccine production prior to the construction of its new suite, providing fill/finish services for Moderna’s COVID-19 vaccine in 2021.

However, the new suite extends beyond these drug product services to offer mRNA drug substance services at the same facility. This means that Samsung Biologics can synthesize the mRNA required for vaccines rather than rely on partners to ship the drug substance to its facilities to be loaded into vials and packaged.

Huisub Lim, Samsung Biologics’ lead scientist of mRNA manufacturing, and Pierre Catignol, executive vice president and head of manufacturing, addressed the significance of these end-to-end capabilities in a recent Q&A on the future of mRNA vaccine production.

“The global mRNA vaccines and therapeutics market is forecasted to grow steadily in the next few years,” they explained.

But they also noted that not many manufacturers are optimally equipped to meet this growing demand.

“Few manufacturers/CDMOs are adequately equipped or capable of carrying out all manufacturing steps, leading to logistical, monetary, and timeline difficulties. Frequent handling of mRNA across multiple locations increases contamination and degradation risks. When the entire work stream is coordinated by one partner, from a single location, transitions across development and production tasks run smoothly, maximizing efficiency and mitigating potential risks.”

Recognizing this gap, Samsung Biologics decided to invest in expanding its capabilities to offer partners a full suite of capabilities. Its first project utilizing the expanded suite is a partnership with GreenLight Biosciences to produce the Massachusetts-based biotech company’s COVID-19 vaccine candidate at commercial scale.

Samsung Biologics’ completion of the project’s first production run in August indicates the speed at which end-to-end mRNA vaccine production capabilities can meet large-scale manufacturing goals. The first run of vaccines was completed seven months after the beginning of technology transfer, producing 650 grams of mRNA with a titer of 12 grams per liter at commercial scale.

“One of the greatest challenges when producing quality pharmaceuticals is advancing from a small lab to large-scale commercial production,” said GreenLight CEO Andrey Zarur in a press release on the completion of the first run. “We are grateful for the help and support of Samsung in demonstrating that our small mRNA process can scale in a linear fashion to the industrial scale that will be needed to help satisfy the vaccine needs of humanity.”

For Rim, the project is both part of the CDMO’s continued effort to combat the COVID-19 pandemic, and the first step in an effort to become a leader in mRNA production as the market expands beyond COVID-19 vaccine applications, with potential applications in areas such as cancer treatments, heart disease, and HIV.

“This demonstrates a major achievement in our continuing goal to offer one-stop end-to-end mRNA production from drug substance to aseptic fill/finish to commercial release, all from a single site, as we strive across our biomanufacturing network to fight the pandemic.”

Multidimensional CDMO Growth

Rim has outlined a multidimensional growth plan for Samsung Biologics based on three pillars: portfolio diversity, an expanded international presence, and increased biomanufacturing capacity.

While the CDMO’s production of monoclonal antibodies continued to be a revenue driver in quarter three, the quarter demonstrated the impact of the CDMO’s portfolio diversification efforts as well. In addition to expanded mRNA vaccine production, Samsung Biologics’ recent full acquisition of Samsung Bioepis, a biosimilars company that had been run as a joint venture with Biogen, also impacted Q3 earnings.

This diversification effort has helped lead to a third consecutive quarter of year-over-year revenue growth in 2022. Samsung Biologics reported 96% growth in Q1, followed by 22% in Q2, and 94% in Q3.

As it continues to experience revenue growth, Samsung Biologics is investing back into expanding its capabilities and workforce. It recently began partial operations at its fourth manufacturing plant at its headquarters in Songdo, South Korea. The plant is the largest of its kind in the world at 240,000 liters of capacity and when fully operational, will bring the CDMO’s total capacity to 604,000 liters.

It also recently purchased land to construct a second Bio Campus. The 357,366 square meters of land in the Incheon Free Economic Zone will house additional manufacturing plants as well as an open innovation center, and it is expected to create as many as 4,000 new jobs in the region by 2032.

With the global biopharmaceutical market valued at $360 billion as of 2022 and predicted to grow at an annual average rate of 10.3% by 2026, Samsung Biologics’ multidimensional growth strategy is in line with projections for increased demand for biologic products.

Industry experts expect mRNA vaccine production to play a significant role in this industry growth, and the recent success of Samsung Biologics’ mRNA investment is evidence of this potential.