In this modern age, no one carries tons of cash when going outside or doing a business meeting. It feels awkward sometimes to carry a huge amount of cash along to pay bills. Since the risk of being robbed and nervousness escalated. We are living in the digital world, and there are all digital solutions for each thing, whether it’s communication, ease of living or payments. Everything becomes easy than we used to think. Now payments that we made from our credit card, or debit card are safer but there had been a few incidents reported where merchants faced huge cash losses due to not having much security for payment cards. Then in 2001 tokenization payment meaning https://www.verygoodsecurity.com/blog/posts/network-tokenization-for-beginners was introduced by a company Trust Commerce for their clients in order to ensure the extra security of their payment cards. As this concept was quite important to lessen to worry of being hacked and lessen the risk of any fraudulent activity. In this article, you will get to know about the process of payment network tokenization and how it works. Let’s get straight into this.

What is payment network tokenization?

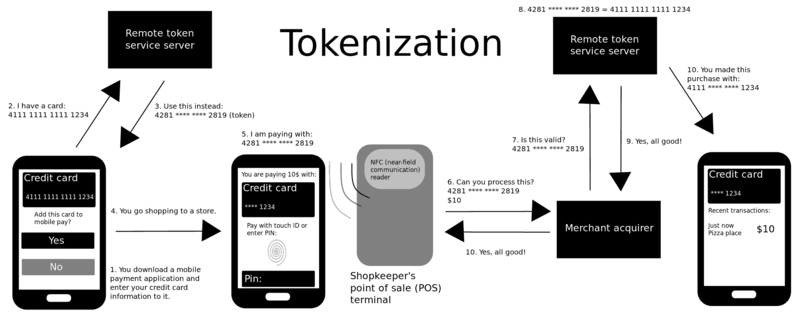

Payment network tokenization is primarily a type of card tokenization which is offered by the payment card providers like Mastercard, Visa cards or American Express which mainly exchange your primary account number PAN and other card credentials by using a token issued by the card provider.

The main goal is to ensure that payments should be transacted safely. These types of features help customers a lot when paying national or international huge sums of money. When the implementation of network token is done, it ensures the safer payments all throughout the payment ecosystem by getting rid of the need for a third-party resource to showcase itself to endanger handling the Primary account number and the rest of the confidential data.

Do network tokens play an essential role in the business?

People ask this question a lot that is it true that network tokens are helpful to businesses? So, yes! The exceptional growth in credit cards for e-commerce payments through payment cards like Mater cards and Visa cards necessarily offer the network token feature which is designed to exchange the card number with the merchant-specific token.

Alike the normal card number, the replacing token value count is also the same.

- These tokens are issued generally for partnership purposes from the respective banks. Resultantly the bank tokens have a much higher token authorization rate as compared to the other payments that are made without tokens. They are less secure and feasible.

- Both parties enjoy a good user experience as their token network gets instant updates to the card providers. Merchants and small businesses may also this leverage.

- These token-based payments have improved the security level of transactions as a result no fraudulent activity or any illegal interference is faced in this process.

What is tokenization?

Tokenization is mainly a surrogate or proxy value that is generated by the card provider to replace the original card number to not be exposed when making transactions. The main purpose of using this proxy value is to just protect the original card number. Although values that are used, in general, have no relation between the card number and the token number. The value of numbers is irrelevant and illegible so no one could read and get any useful information. The surrogate token value is the same as the length of the original card value. There is no difference in that. This is the same as the 16 digits long, but it differs in the choice of numbers. There is no mathematical relationship between the token value and the official card number. You will be amazed that how this token value could represent the original card value. But all in all, it is important to meet international security standards.

What are network tokens?

These are the tokens which are mainly the credentials particular to a merchant card pair which can easily replace primary account numbers to make payments digitally. Every card’s token value is different and unique for each business, such network tokens may not be used in businesses. These network tokens are applicable with card provider companies like Mastercard and Visa card for tokenizing the users’ account numbers directly into network tokens which will be easy to maintain. even if the primary card information gets changed. For instance, if a cardholder lost the payment card, the token network will be notified from the payment card networks and they would further upgrade the old token straightaway. So, that it continues its operation without disturbing the customer.

What is the encryption process?

This is a process in which the card credential and other sensitive information are modified mathematically, still, the official pattern of information is shown within the modified code. This basically means that the encrypted value may be decrypted by using a special key which may be stolen from the database.

Can tokenization get hacked?

Well, as earlier mentioned, the process of tokenization is way safer than the encryption process used in the masking of card credentials. To put it in a nutshell, encryption is just like a lock box and the network tokens are like the poker chip. This is an exceptional example to understand the difference between both tokens and the encryption of cards.

Why tokenization is future of the financing?

A study conducted by Ghent University that shows, tokenization potentially may be helpful in cost saving up to 4.5 billion $ by the end of 2030. Moreover, the tokens are helpful in improving the customization payment opportunities and the whole world will be fascinated by the extraordinary security and enhanced financing sector.

Conclusions:

If you are a business owner and want to have a perfect and secure payment ecosystem, then the token payment system. This is quite simple, and you won’t have to deal with any kind of technicality, if you have seen the financial report then the token system is a boom in saving costs and proving other benefits. Be sure before to avail of any of these services.