The payment gateway makes it possible to move payments between customers and merchants and to deliver secure transaction data to banks. The merchant ensures that the processor receives the processor’s protected customer information from the payment gateway. Online payments follow online purchases. Payment gateways are becoming more and more common as a result of the rise in internet transactions. Online transactions let clients make secure payments while contributing to the fight against fraud. Installing payment gateway services has the additional benefit of reducing costs by doing away with high payment processing fees. The process is easy to understand and uncomplicated. Nevertheless, there are some risks involved. As online fraud has significantly increased, you must use Acuitytec risk management while making payments online if you want to perform secure transactions.

What Is Payment Gateway?

A payment gateway is a technology that allows online merchants to accept payments from customers. It allows them to process transactions through a secure platform. This platform also provides merchants with the ability to track the spending of their customers. The payment gateway also provides security for merchants by verifying the identities of their customers.

This processor will take care of all the details involved in processing payments, from authorizing the transactions to issuing refunds. This makes it easy for you to focus on running your business and doesn’t require any extra time or effort from you. Merchant payment fraud prevention and risk management can reduce online payment fraud.

It allows customers to make payments by completing transactions on the merchant’s website. This process is usually faster and easier than paying with a credit card, and it eliminates the need to carry large amounts of cash around. Payment Gateway also protects merchants from fraudulent activity, and it can help them increase their sales. It is an important part of the e-commerce process because it makes it easier for customers to pay for products and services.

How do payment gateways operate?

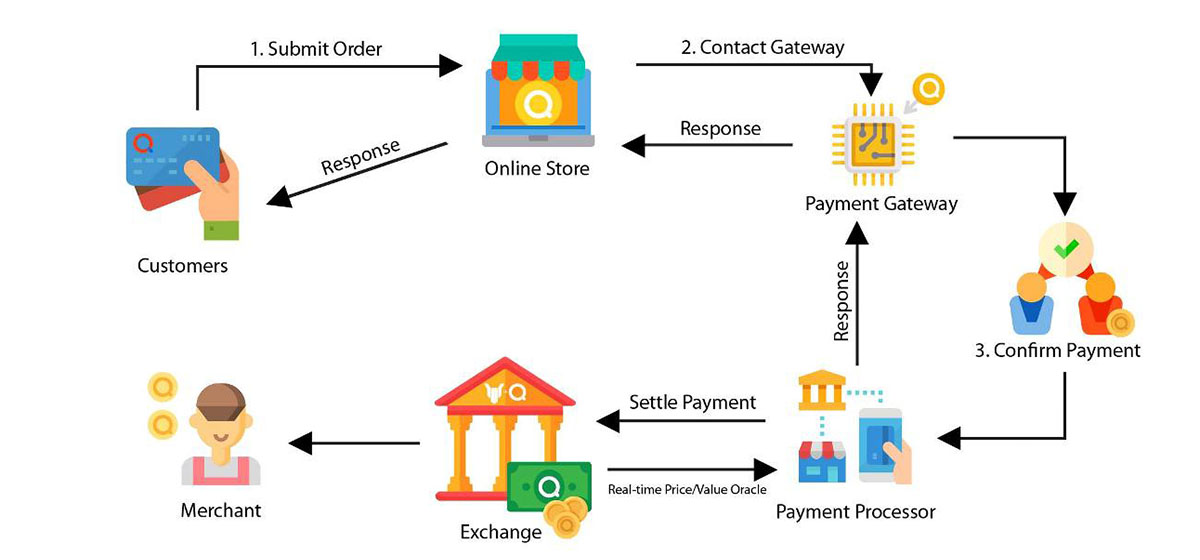

A payment gateway is software that helps businesses accept payments from customers. It allows businesses to process payments from customers through a secure server. This eliminates the need for businesses to have their own credit card processing system. Payment gateways also provide merchant account services, which allow businesses to take credit and debit card payments. Payment gateways are devices that allow customers to make payments using a variety of methods. These methods include credit cards, debit cards, and digital wallets. They also accept payments through phone apps and online platforms. Payment gateways work by receiving payment information from the customer and then passing it on to the merchant. This allows merchants to accept payments without having to have an understanding of the payment system.

Payment gateways work by verifying the payment information that a customer provides. This information is usually entered into the gateway through a web form or an application. The gateway then stores this information and processes the payment when a customer makes a purchase. The most popular payment gateways are those that are used in online stores. They allow customers to make purchases without leaving the website.

How can you ensure the safety of your payment system?

One way to make your payment system more secure is to use a secure payment gateway. This will encrypt all of your data, making it difficult for anyone else to access. It will also help you track the whereabouts of your customers and keep track of your finances.

Make sure the vendor has a strong reputation and can offer evidence that the order is legitimate before placing an order from them. In our digitally evolved culture, data breaches are already frequent. No organization is safe from the nefarious actions of hackers who aim to breach into businesses in order to steal vital consumer data, whether they are big corporations or tiny businesses. If you own an internet presence, make sure your payment method is more protected and encrypted so that clients can trust you. Payment risk management can reduce online payment fraud. Online payment acceptance is getting more and more challenging as online shopping grows in popularity. This will help protect your data from being accessed by unauthorized people. Using a Secure Payment Gateway solution will protect your company from financial fraud and damage brought on by cybercrime.